GETTING STARTED

INSURANCE COMPANY STORIES

SERVICE PARTNER STORIES

API BASICS

API ENDPOINTS

COMPONENTS

LEGACY

Fraud Alert

Idea behind this page is to provide a clear understanding of how Scalepoints Fraud support solution works, and what are the reasons to implement this solution and also describe how the technical solution is going to implement.

Objective

The main objective of this project is to support inusrance companies in helping identifying the fraud claims and notify them immediately.

Why?

Today insurance companies are facing a problem with fraud and they have identified that 10 to 20% of the registered claims are fraud. Being an insurance industry IT solutions provider and as a scalepoint company we want to help Insurance companies in identifying the fraud cases as soon as possible in the process of case settlement. Today we do not have any fraud detection solution to prevent the fraud being happening, but we would like to integrate with their systems and help insurance companies in preventing the potential fraud claims.

Solution

The solution is to inform the Insurance company every time a claimline is created/removed/modified, and they will use their internal systems to find out about the potential fraud and they will inform us. With the provided information scalepoint validation engine could stop that potential claim being settled immediately. Idea is that, when ClaimShop receives the fraud status from our customers, ClaimShop will visualize the status on Scalepoints Settlement Page.

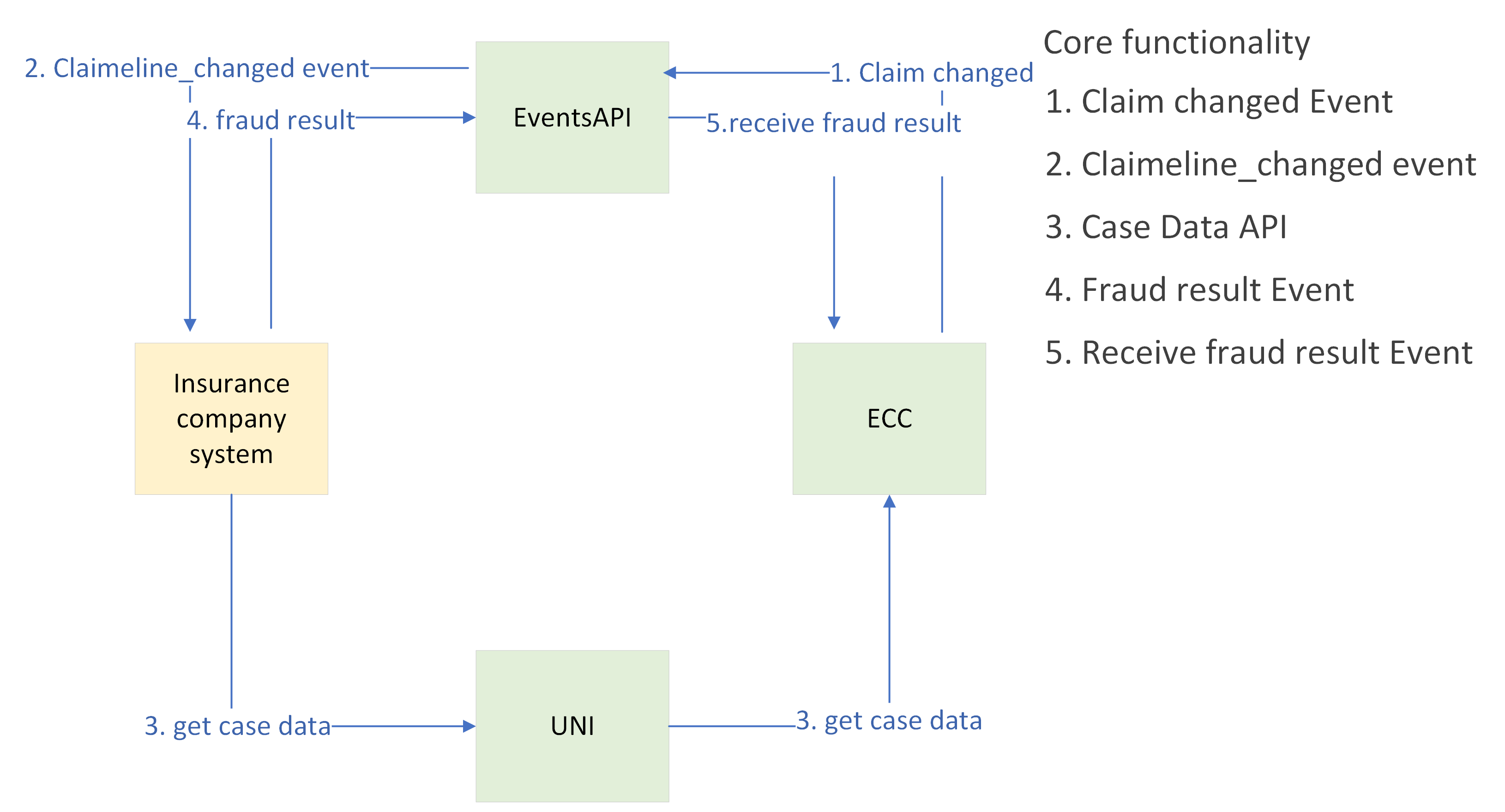

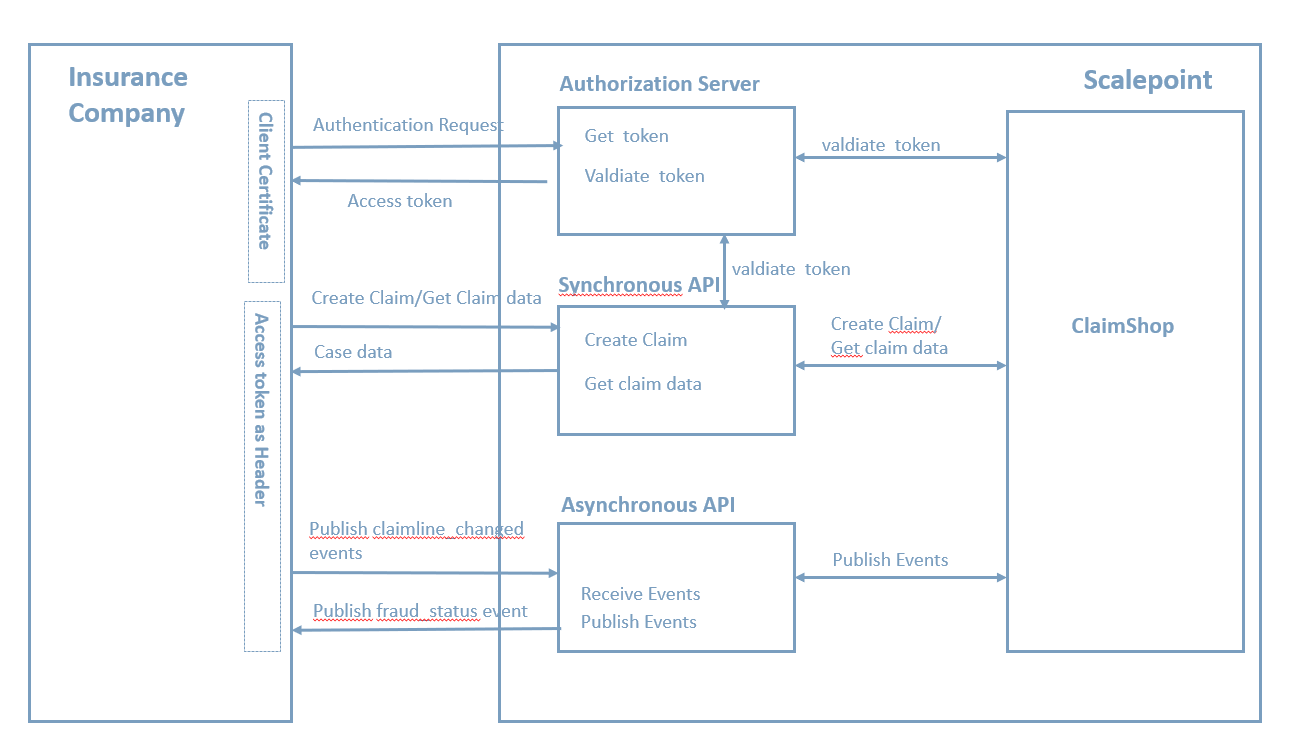

Below high level architecture diagram and sequence diagrams explains how the flow should be between Insurance Companies and Scalepoint Contents system.

Systems Involved in this solution

- Insurance Company Back-end

- Authorization Server

- Event API

- Unified Integrations

- ClaimShop

Authorization Server: For more information regarding how Scalepoints Authentication & authorization works please read Authentication

Event API: For more information regarding how Scalepoints bi-directional Event API work please read events-api

Unified Integrations: For more information regarding how Scalepoints Case Create API works please read case-integration-api

ClaimShop(ClaimShop): scalepoint-claimshop

High-level Architecture

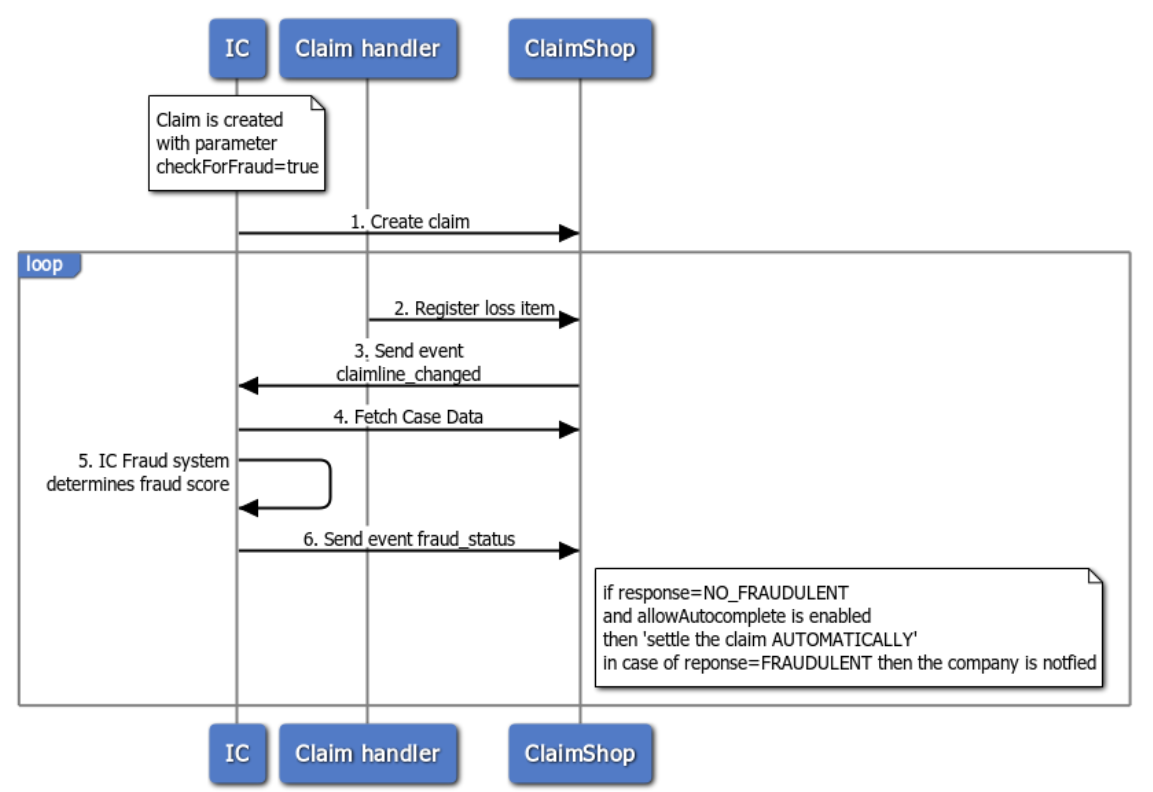

Web Sequence Diagram Loss Items Manually Imported

In the above sequence diagram, as soon as a claimline is added, ClaimShop will publish an event and insurance companies will consume that event and get the required case data using our Case Data API and determine the fraud status. Once they have determined the fraud status IC will publish a fraud_status event to Events API and informs ClaimShop whether the claim is FRAUDULENT or NOT_FRAUDULENT. The fraudulent status will be shown on a settlement page.

In this solution, we will send each and every claim line changes to our clients via Events and vice versa.

In this flow every thing is happening via events, this way we will not directly depend on clients response times.

We assume that, we will receive the fraud status some time in the future and we will show FRAUD DETECTION IN PROGERSS for the period of detection untill we get the response.

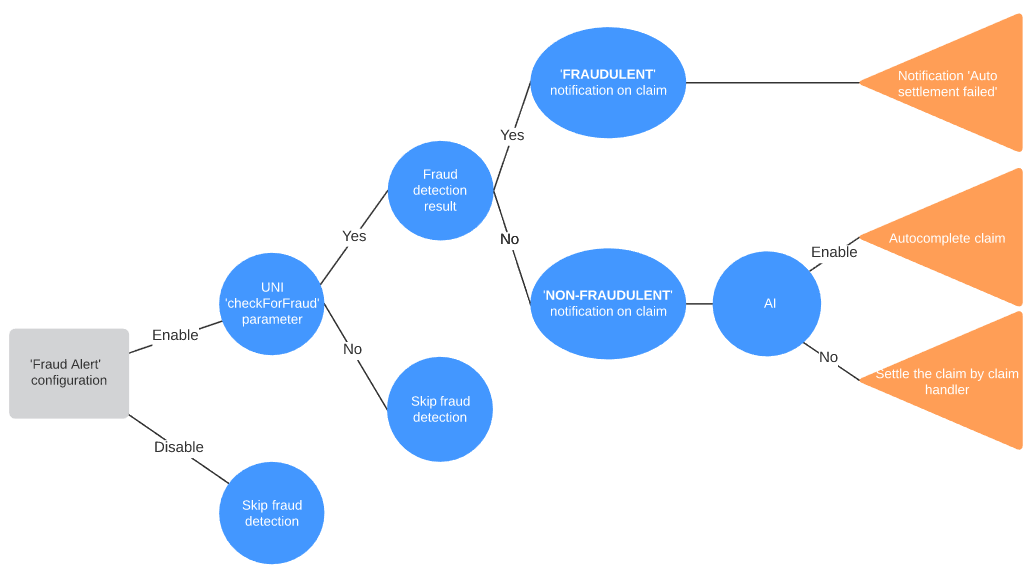

Please see the decision tree on how the application will react in all the time.

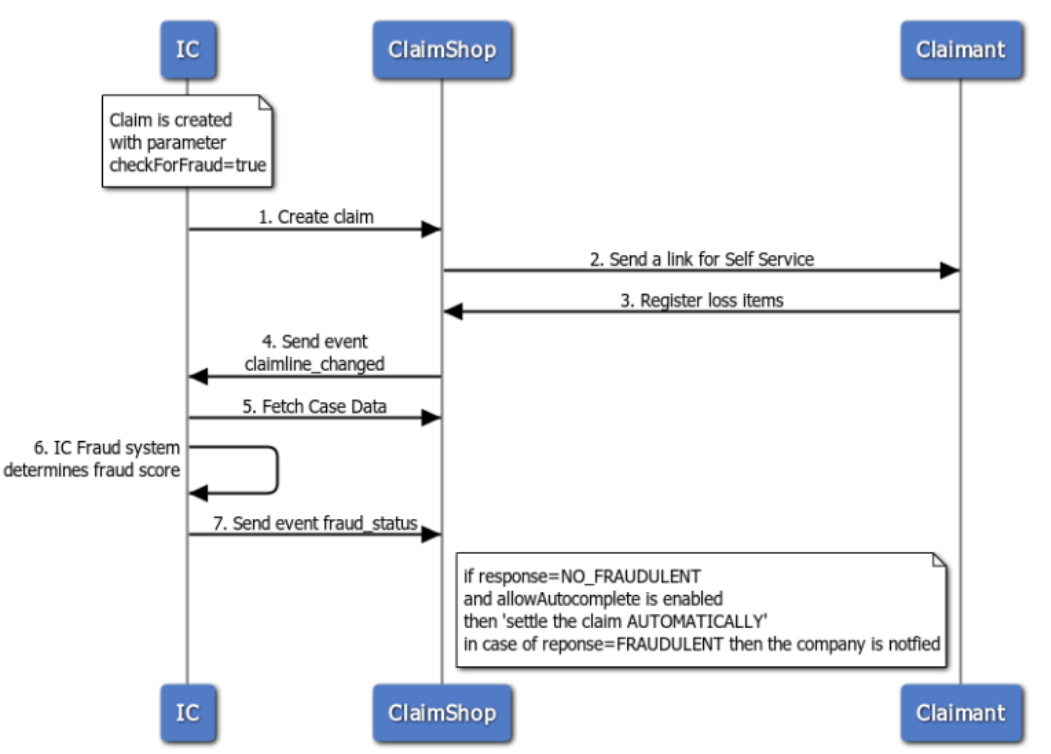

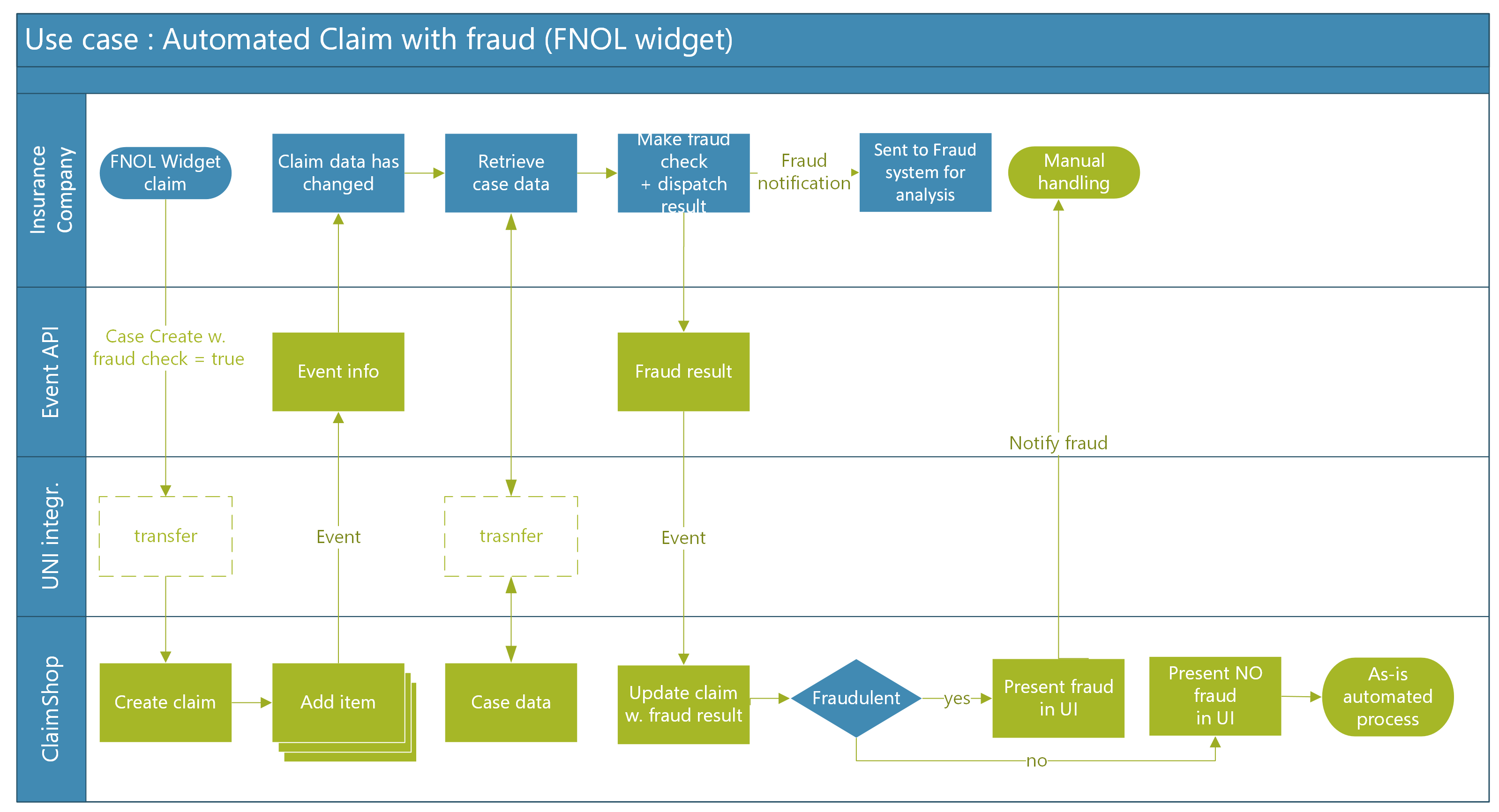

Web Sequence Diagram Loss Items Automatically Imported

In the above flow diagram, as soon as a claimlines is added to our contents system ClaimShop will publish an event and insurance companies will consume that event and get the required case data using our Case Data API and will detemine the fraud status. So once they have determined the fraud status they will publish updated fraud status as an Event to Events API and informs ClaimShop whether the claim will be able to process further or not. If the case is fraudulent then auto settlement is stopped and event auto_settlement_failed is sent to EventsAPI to notify insurance company.

Solution Description.

- Claim Line Change Event - Every time when a Claimline added, claimline deleted, claimline modified this event will be sent. Please refer to the documentation for detailed description

- Fraud Status Event - IC will publish when they have calculated the fraud status. Please refer to the documentation for detailed description

- Auto settlement failed Event - ClaimShop will publish event when auto settlement is stopped due to fraudulent status (automatic flow). Please refer to the documentation for detailed description

- Case Data API - Provides case date via REST API. Please refer to the documentation for detailed description

- Create case API How to create a claim in ClaimShop. Please refer to the documentation for detailed description

Decision tree

High level Uses Cases

In attached Visio document most common use cases are illustrated, currently the following use cases are covered.

Use Case overview (current version 0.6):

Manual Claim with fraud

Automated Claim with fraud (FNOL widget)

Core functionality