GETTING STARTED

INSURANCE COMPANY STORIES

SERVICE PARTNER STORIES

API BASICS

API ENDPOINTS

COMPONENTS

LEGACY

Unified Payments

Introduction

This page defines the Customer Implementation guide for Scalepoint Unified Payments solution.

Goal of this page is to provide a clear understanding on how the solution should be integrated, and what requirements does this put on you, which dependencies exist, and in what order should thing be done in order to have a succesful implementation.This is based on Scalepoint best pactice experience from past customer implemntations.

In this page we describe below sections

- What are the current issues

- What is the Solution? and what are the advantages

- What events/notifications will be sent part of this solution.

- How customer can receive payment information using Webhooks mechanism when a claim get settled inside Scaelpoint ClaimShop application.

- What customer should provide to Scalepoint to kick-start the project

- Go-live checklist

Issues with current solution:

- Current payment Integration's are old and legacy. Systems upgrade(webservice URL change or renew of a certificate) requires a lot of testing.

- Lack of flexibility in the current payments integrations. It requires quite some development from both ends for some small changes also. Its quite expensive to make changes

- These payment integrations are very tightly integrated so when ever we want to extend with new attributes its consuming quite some time for us and also to our customers since it requires a lot of testing on both sides. Certainly this is causing the go to market time high.

- Each integration have its own way of doing the authentication and authorization, and its often challenging to get an overview of the integrations. From our histroy, customers are spending a lot of time on doing authentication and authorization

- Payment Information from Scalepoint to Customers is sent only once. Customers do not have the possibility to get more than once.

- RV (Repair&Valuation) payment information is not handled (*ClaimShop only).

With above issues kept in mind and to follow industry standards scalepoint have implemented a unified payment solution which will be used across all Scalepoints applications(Contents, Property, etc.. ).

Advantages with new solution

- Unified implementation - this solution will be used across all Scalepoints applications, so only one integration towards Scalepoint from customer

- Secure communications - usign industry standard Oauth2.0 and we are on our way to do 3-legged OAuth

- Secure only one time - All Scalepoint APIs are protected by the same authentication and authorization so customers have to do the authentication and authorization only once. when scalepoint inroduces new API's then its only using the new scope. This way customers do not have to spend a lot of time on authentication and authorization.

- Fast time-to-market - Solution is based on event based integrations that means systems will be lossely coupled, so upgrading of systems or new changes could be introduced quickly

- Low cost of development and maintenance - changes could be developed with out depending on each other, changes can be introduced on their own phase. No need to test the whole application on both ends for simple changes.

- Solution is based event based integrations - Information is freely flown between two systems.

- Information is available via our REST Apis - Customer can access the settlement information any given time (*ClaimShop only).

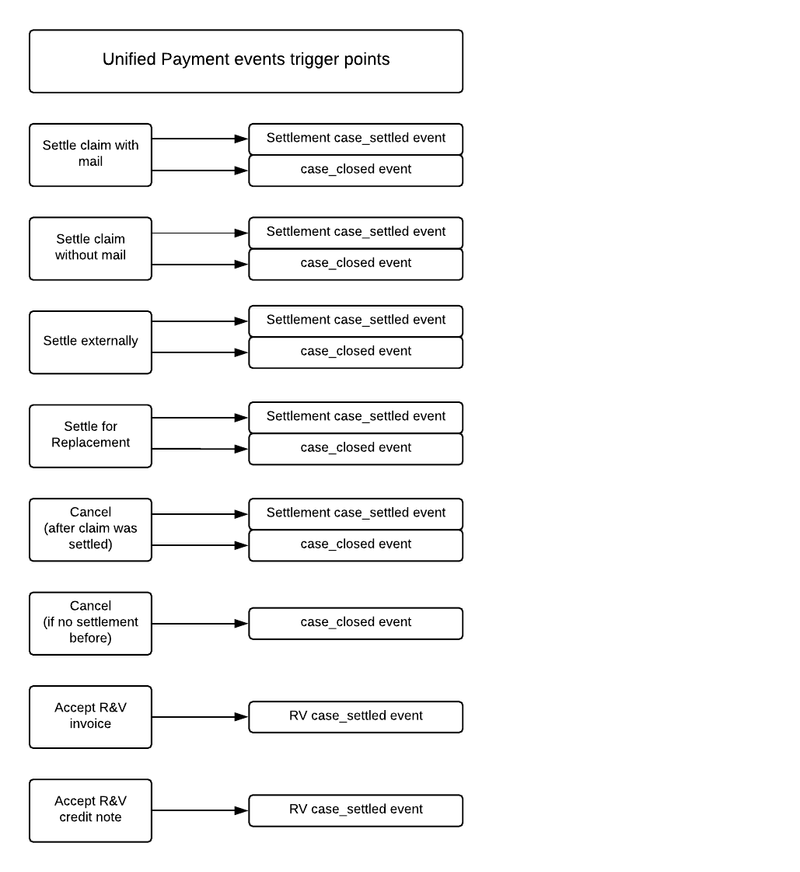

- Payment event aka

case_settledevent json schema is common for all of Scalepoint Products. - RV (Repair&Valuation) payments are handled via

case_settled(*ClaimShop only).

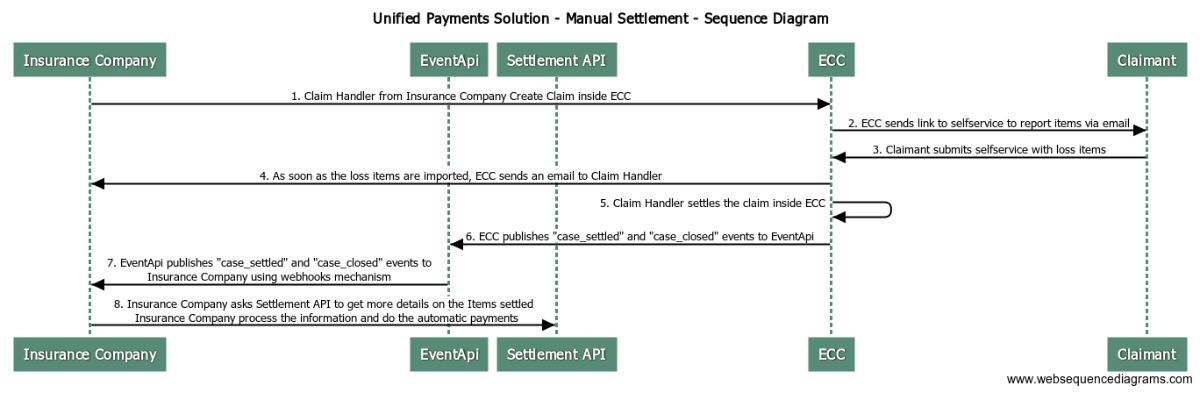

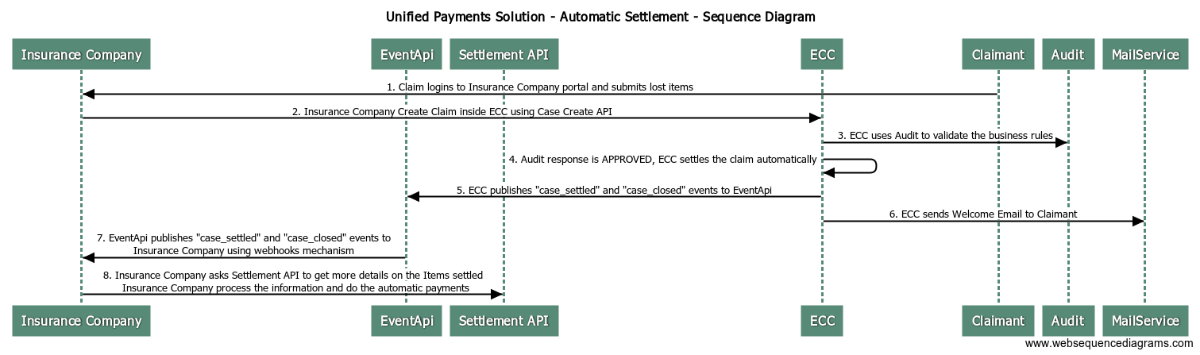

In this Unified Payments solution, payments information will be published as an event using webhooks mechanism and customer have to fetch more details on the settled items using our Settlement API.

How does it works in ClaimShop?

Unified payments solution consists of events and a REST API.

- Claim Settled Event

- Claim closed Event

- Settlement API

Claim Settled Event provides information related to Payments,

- Please refer to the documentation for detailed description about the case settled event.

- Please refer to the JSON Schema for JSON schema

- Please refer to the documentation for detailed description about the JSON schema attributes.

- Please refer to the JSON Example of Case_Settled Event for an example of case_settled event.

Claim Closed Event provides information about a claim should be closed in client’s backend system or not.

- Please refer to the JSON Schema for JSON schema

- Please refer to the documentation for detailed description about the JSON schema attributes

- Please refer to the JSON Example of Case_Closed Event for an example of case_closed event.

Settlement API Provides information related to settled items,

- Please refer to the JSON Schema for JSON schema

- Please refer to the documentation for detailed description about the JSON schema attributes

- Please refer to the JSON Example of settlement-api for an example response of

Settlement API

So when a claim handler settle the claim, ClaimShop will generate a Claim Settled Event. Part of this Case Settled Event consists the Settlement object and which consists of Revision Token.

This Revision Token will be used in Settlement REST API to get the settled items.

"settlement": {

"approvedBy": {

"email": "kevin.andersen@somedomain.com",

"name": "Kevin Andersen",

"type": "user"

},

"revisionToken": “f80245d2-d4a2-4f41-b488-bfb470ee48be”

},The endpoint could look something like this:

https://<hostname>/webapp/ScalePoint/dk/case/abcinsurance/revision/d1a72df4-f7d5-402c-a495-cc31b8b39a59

Authorization

Please refer to the documentation about details of authentication process.

Both Event API and Settlement API uses same Authorization and Authentication mechanism, the only difference is they use different scopes. Event API uses “events” scope and Settlement API uses “platform-case:read"”.

How customer can receive payment information using Webhooks mechanism

Please refer to the documentation on how to receive events using Webhooks mechanism

How customer can get settled items details

Please refer to the documentation on how to receive more details on the settled items details

High level overview of Unified Payment Solution.

Below architectural diagram depicts how scalepoint and insurance companies are going to be integrated part of this solution

Systems Involved in this solution:

- Insurance Company Back-end

- Authorization Server

- Event API

- Unified Integrations

- ClaimShop

Insurance company Backend: Insurance company backend system which could be able to integrate with Scalepoint backend systems

Authorization Server: Please refer to the documentation about details of authentication process.

Event API: Please refer to the documentation about details of event api

Unified Integrations: Please refer to the documentation on how to user Create Case API and also able to retrieve Case Data

ClaimShop(ClaimShop): Please refer to the documentation on how ClaimShop application works.

Inside ClaimShop a claim can be settled manually or automatically.

Sequence Diagrams

Unified Payments Solution - Manual Settlement Sequence Diagram

Unified Payments Solution - Automatic Settlement Sequence Diagram

Unified Payment events trigger points

Go-live Checklist for Customers

- Production ready certificate, so scalepoint ITO could add to our Atuthorization Server well in advance

- Production ready webhooks service to be able to receive events from Event API

- In case of using the IP whitelist solution, add scalepoint public IP address to firewall.